By Alan Coleman on 21 Apr 2020

The Weekly Online Economy Report - April 20th

As Featured In

.jpg)

.jpg)

We’ve analysed over 48 million website sessions and over €172 million euro in online revenue over the past 11 weeks (Mon-Sun), to compile a weekly report covering the previous week's movements in the online economy during the Covid19 crisis.

The first four weeks fell in February and were before the Covid19 crisis took hold. The next 7 weeks are from March into April when the crisis started to escalate. When we say 'last week' we are referring to Monday 13th - Sunday 19th April.

Here are last weeks figures:

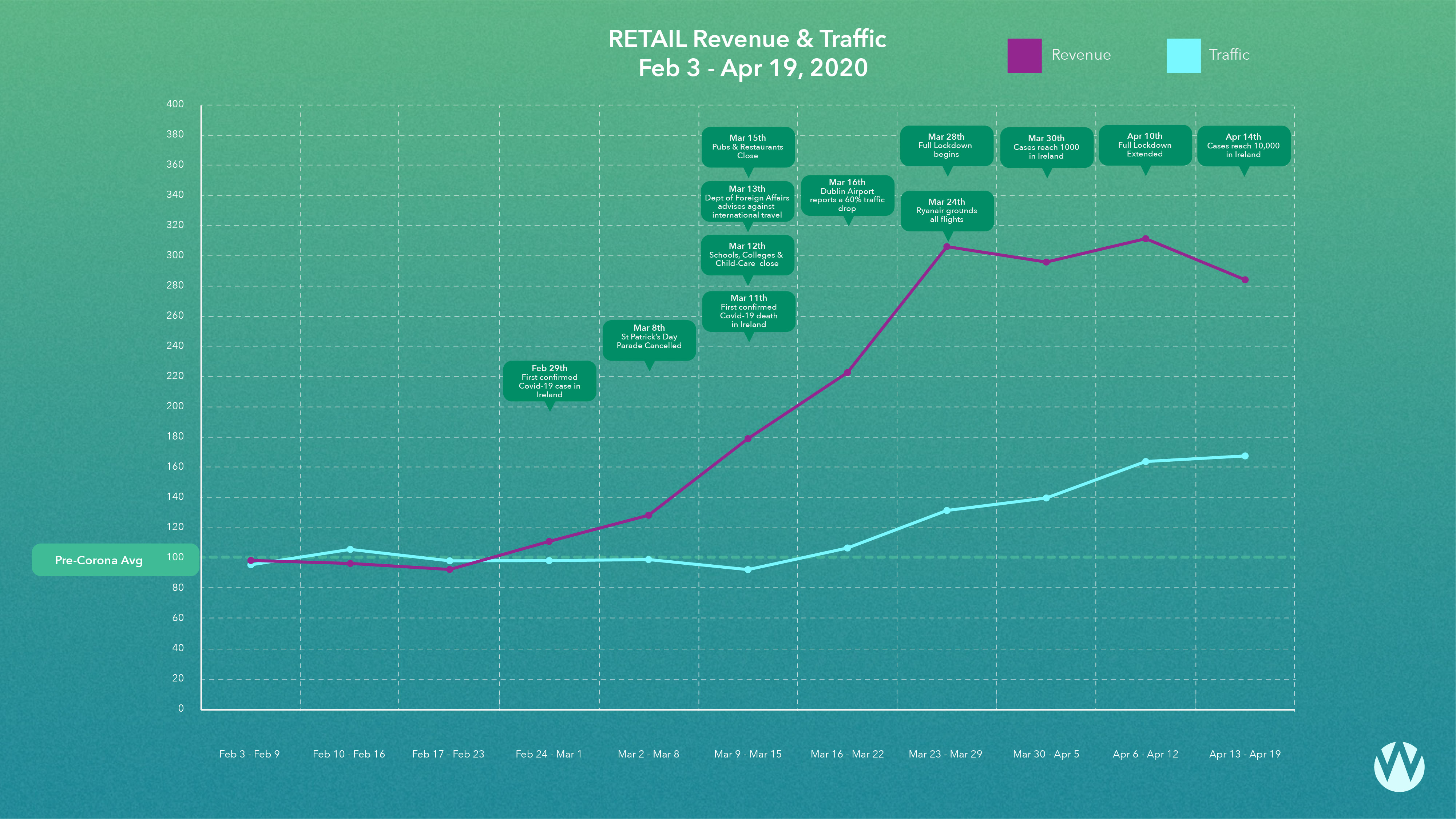

Retail

April week 3 saw a 68% increase in traffic on pre covid levels for online retailers. This is trending upwards and the highpoint in traffic levels. For many retailers it was among their busiest weeks for online traffic ever.

The peak in traffic suggests that online research behaviour is at an all time high.

Online revenues were up 185% . This is trending downwards by 9% on last weeks high. Spends tend to trend downwards as the month progresses and then increase in the last week when consumers get paid. You can follow these peaks and declines in revenue through the month in our retail graph.

The peak in traffic signals that when wages are paid next week, we may see a new peak set in online revenue.

The Enterprise Ireland recent COVID-19 Online Retail Scheme announcement also brings welcomed news to the industry this week. The support has a total fund size of €2m and supports a maximum of 80% of eligible costs with a maximum grant of €40,000 available.

Find out about Wolfgang’s Covid-10 Online Retail Scheme Packages designed to help get your retail operations back on track, including details on how you can apply.

Corona Crisis’ impact on advertising costs

Advertising is traditionally among the first overheads on the chopping block in a recession. This has always been the case. However this is the first recession since performance marketing revolutionised the ad industry. Advertising’s characteristics have changed since the last recession, the financial crisis of 2008. There are 2 interesting questions a business can ask themselves to make more informed decisions around ad spend:

1/ Is there a price reduction already in place as a result of real time bidding?

2/ Is advertising still to be seen as an overhead to be cut, or a cost of sales to be invested in?

Let’s use our dataset to explore these questions.

1/ Price reductions.

Everybody is seeking to cut costs.

With real time bidding, price changes happen automatically for online advertisers.

Google and Facebook’s advertising model is real time auctions. That means the price of a click isn’t determined by the media owner every month or even every week. The cost of a click is calculated every single time an ad impression occurs based on the advertisers in the auction, bidding for that ad click at that time.

Google and Facebook ads cpcs are as liquid and as dynamic as the stock market with billions, yes billions, of ads being served every day.

So if advertisers are leaving the market, then cost per clicks will decline, in real time.

Just as the corona crisis has precipitated a sell off on the global stock markets, we are witnessing a bear market on Google and Facebook CPCs.

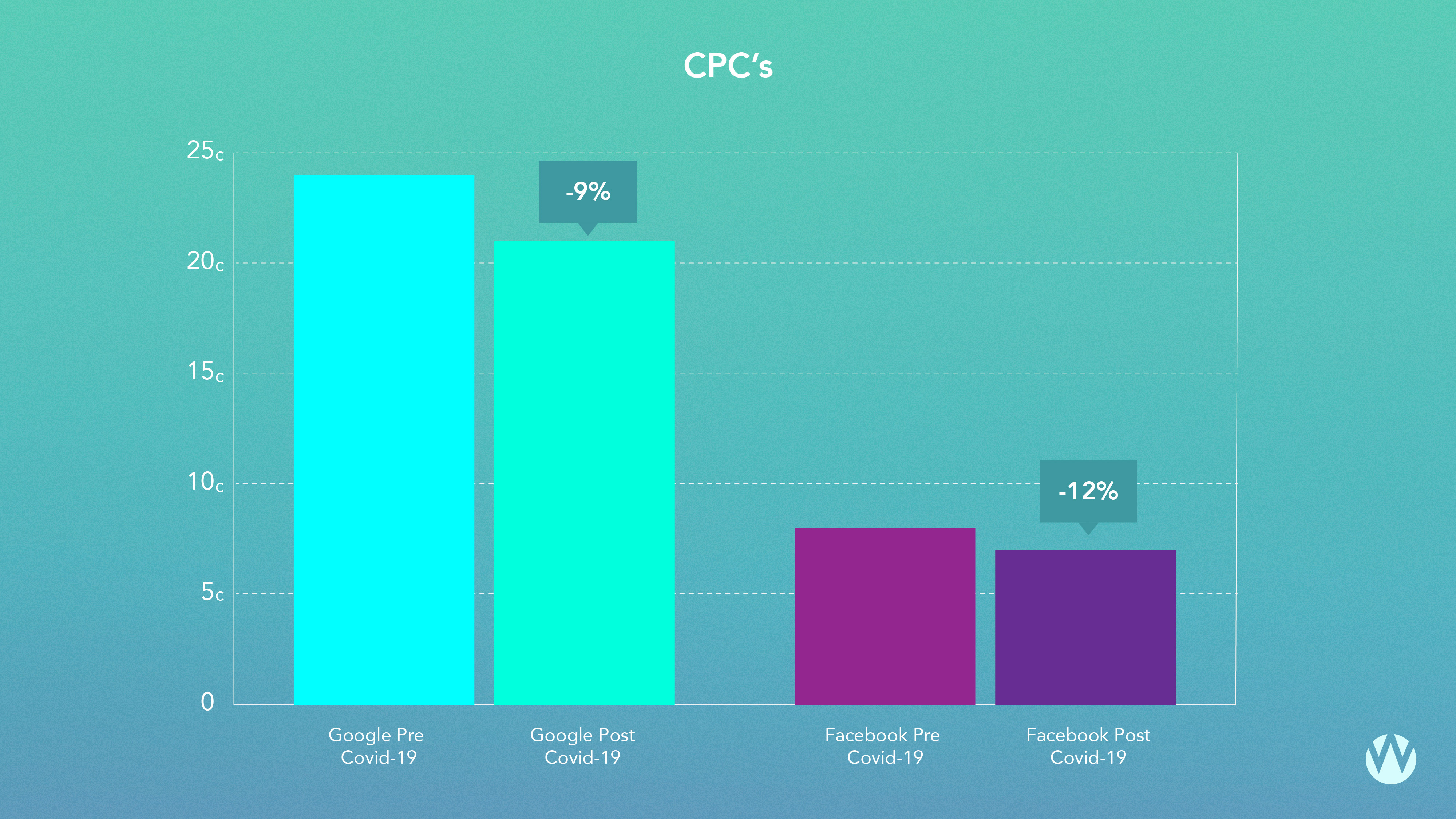

We’ve analysed cost per clicks across our retailers and found Google CPCs have decreased 9% from pre covid average of 24 cents to post covid average of 21 cents. Facebook cost per clicks are down 12% from 8 cents to 7 cents.

This means an advertiser could reduce their Google ad spend by 9% and still expect at least as much traffic. Or maintain spend and benefit from a 10% traffic lift.

These declining cost per clicks, coupled with increasing revenue per clicks make for a multiplier effect on return on investment.

Which leads us nicely into question 2.

2/ So everybody everywhere is cutting costs. But what type of a cost is online advertising? Is online advertising an overhead to be cut or a cost of sale to be invested in?

Businesses traditionally see marketing as an overhead, which should be cut during a downturn to see an immediate benefit to the bottom line.

But what if performance marketing is a cost of sale. And cutting it will see an immediate decline in top line revenue and bottom line profit?

Our data tells us that:

“This is the first recession in history, in which marketing can be viewed no longer as an overhead to be cut, but as a cost of sales to be invested in.”

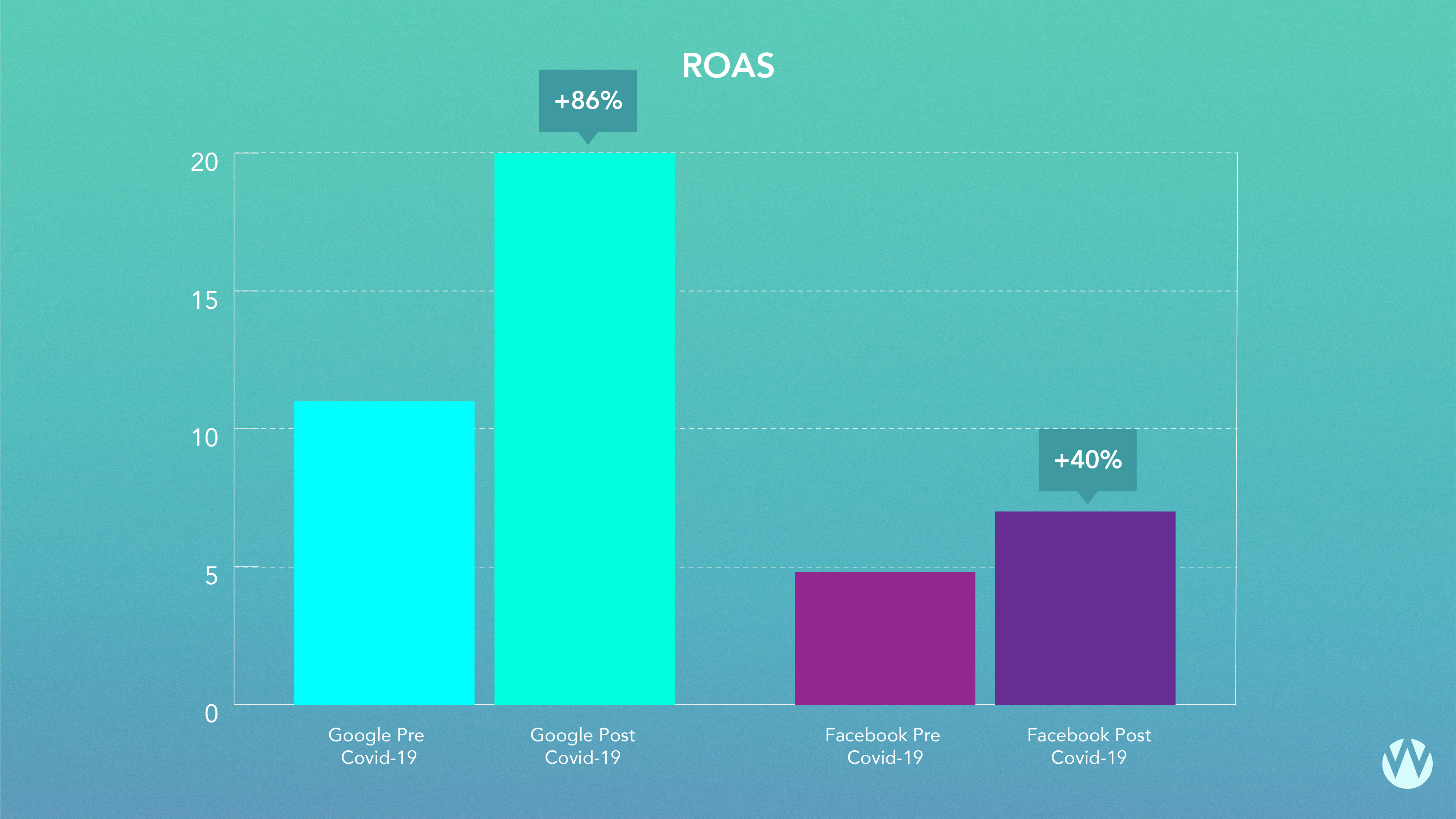

The metric which best illustrates this is Return on Adspend (ROAS). It conveys for every €1 I spend in advertising I receive €Xs in return. This is our favourite metric in Wolfgang Digital.

Google’s average return on adspend for retailers has risen from 11:1 to 20:1. Facebook’s average adpsend for retailers has risen from 4.8:1 to 7:1

When we average out the increase in ROAS across all our ecommerce clients we find that:

Google ROAS has increased by 86% on average.

Facebook ROAS has increased by 79% on average.

There presents a tremendous opportunity for those retailers who are willing to go against the traditional thinking of cutting ad spend in a downturn.

In the investment community, contrarian thinkers such as Warren Buffet famously buy the bear market knowing they will see an exceptional return on their investment in the years to come.

This is the first recession, in which, contrarian thinking businesses can buy the bear market for website traffic and see an exceptional return on their investment, this month.

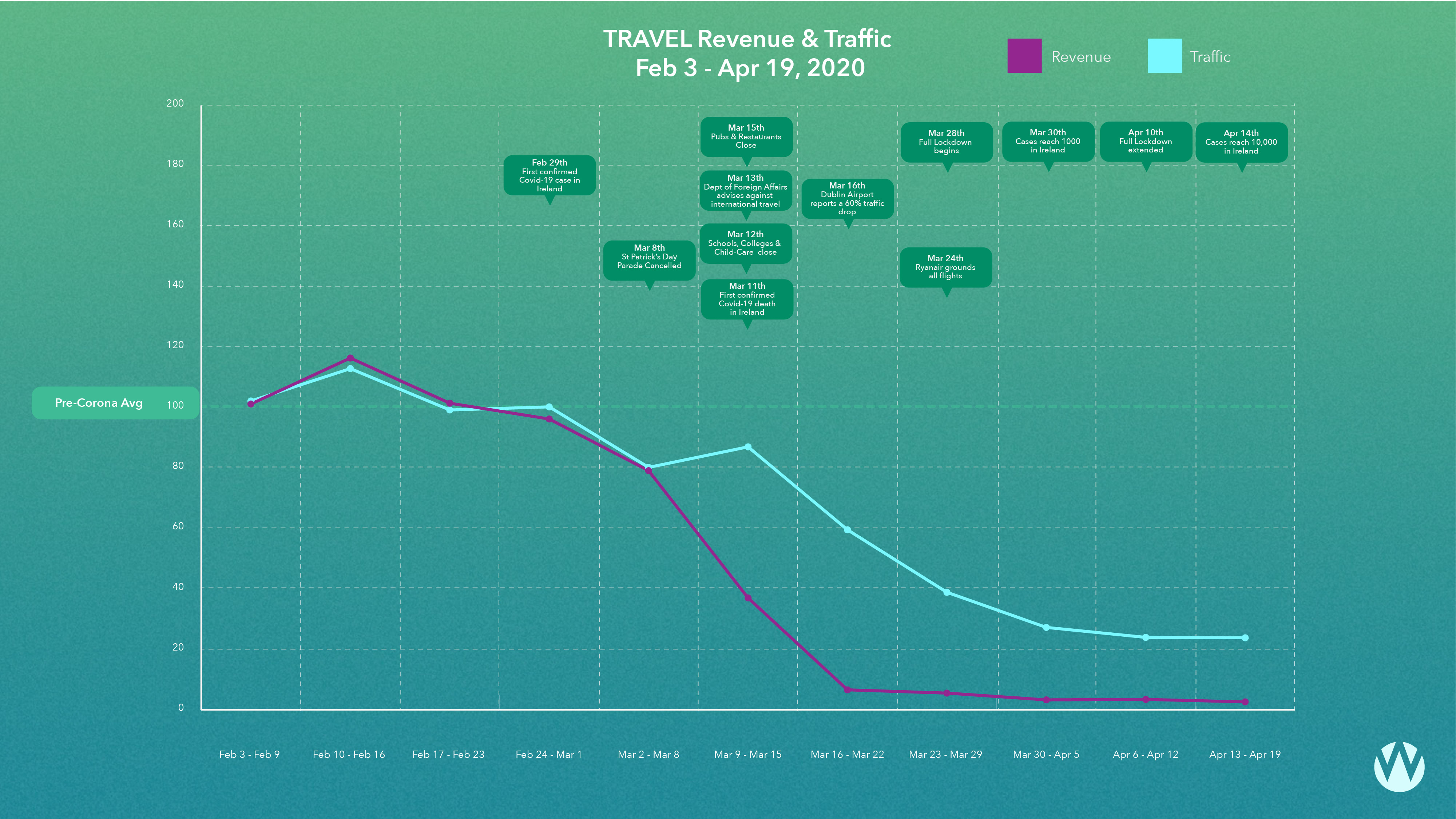

Travel

Last week’s traffic was down 75% on pre-covid levels.

Last week’s online revenue was trending down by 97% of the pre-covid weekly average.

About the data

We have approximately 100 retail and travel e-commerce merchants of various sizes in the data set. We apportion each contributor equal weighting on the final figure regardless of the size of their traffic and revenue. The dataset is dynamic, after we publish figures Google Analytics may continue to attribute revenue to previous weeks. In addition we might add and we might lose participants over time.This may lead to slight variances in the figures as time passes.

.png)

.png)

_2025.png)